Managing payroll in an e-commerce business can feel like solving a math equation while applying for an HR executive job.

The complexities of tracking sales, handling upsells, managing inventory, and ensuring timely payments can quickly become overwhelming.

Enter automated workflows—a game-changer for streamlining payroll management. Here are the seven key tips to transform your payroll process from cart to paycheck.

- Seven Key Tips to Transform Your Payroll Process

- 1. Why Automated Workflows

- 2. Identifying the Needs of E-Commerce Payroll

- 3. Choosing the Right Payroll Software

- 4. Setting Up Automated Payroll Workflows

- 5. Ensuring Compliance with Payroll Regulations

- 6. Monitoring and Analyzing Payroll Data

- 7. Continuous Improvement and Future Trends in Payroll Automation

- Common Challenges and Solutions in Ecom Payroll Automation

- Future Trends in Payroll Automation for E-Commerce

- Wrapping up

- FAQs – Payroll Automation for E-Commerce

Seven Key Tips to Transform Your Payroll Process

1. Why Automated Workflows

A study by Ernst & Young found that the average cost of fixing a single payroll mistake is approximately $291 which can often be avoided easily.

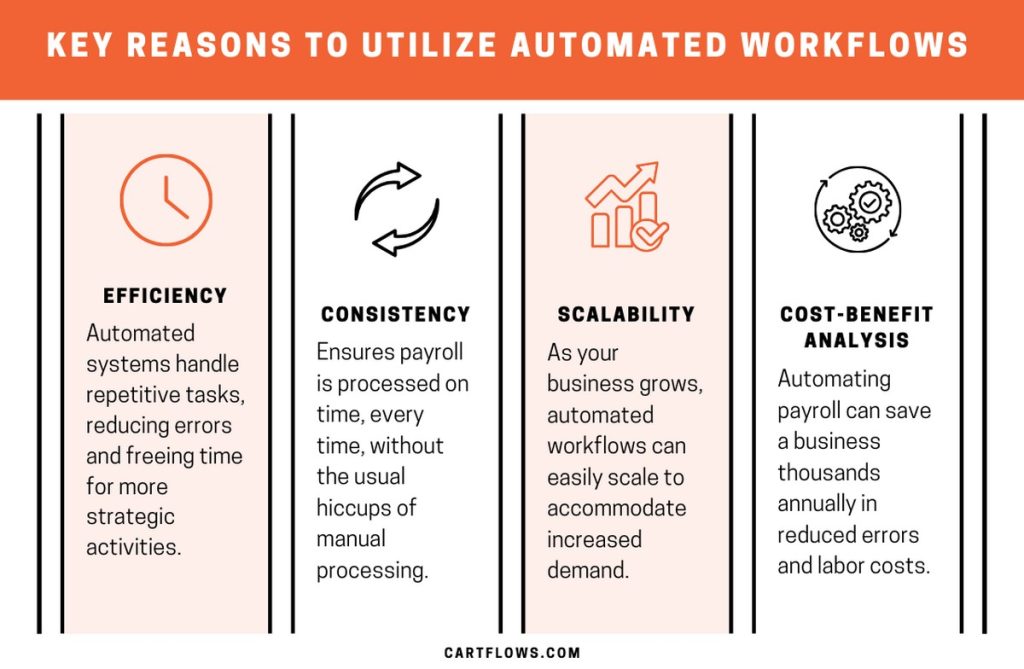

Here are the four key reasons to consider automated workflows –

Efficiency

Automated systems handle repetitive tasks, reducing errors and freeing time for more strategic activities.

Consistency

Ensures payroll is processed on time, every time, without the usual hiccups of manual processing.

Scalability

As your business grows, automated workflows can easily scale to accommodate increased demand.

Cost-Benefit Analysis

Automating eor payroll can save a business thousands annually in reduced errors and labor costs.

Businesses can also simplify their payment process by using tools like an employee pay stub generator to create accurate and compliant records instantly.

Overall, automated workflows can transform payroll management from a mundane chore into a streamlined process, allowing you to focus on growing your business.

2. Identifying the Needs of E-Commerce Payroll

Before jumping into automation, it’s crucial to understand what your business specifically needs.

Factors to Consider:

- Size of Your Business: Small businesses might need simpler solutions, while larger operations require more comprehensive systems.

- Employee Count: More employees mean more data to handle – making HRMS tools essential for efficient management and streamlined operations.

- Payroll Frequency: Weekly, bi-weekly, or monthly? Your schedule will dictate the necessary automation capabilities.

- Seasonal Fluctuations: E-commerce businesses often experience seasonal spikes. Your system should handle these variations smoothly.

- International Payroll: If you operate globally, ensure your software supports multiple currencies and complies with international laws.

Pro Tip: Conduct a thorough assessment of your current payroll process. Identify bottlenecks and areas prone to errors. This insight will guide your selection of the right automation tools.

Interactive Elements

Use a checklist or a self-assessment tool to evaluate your payroll management needs.

Understanding these needs ensures that you select the most effective automation tools to streamline your payroll processes efficiently.

3. Choosing the Right Payroll Software

Selecting the best payroll software in India, US, or anywhere considering your business location, is never easy. It’s more like choosing the right running shoes for a marathon. The wrong choice can leave you with blisters—or worse. This is where aggregator sites like Find HR Software come in.

Essential Features:

- User-Friendly Interface: Look for software that’s intuitive and easy to navigate.

- Integration Capabilities: Ensure the software can seamlessly integrate with your existing e-commerce systems. Explore the integration possibilities of state-of-the-art FP&A software in conjunction with payroll systems to achieve exceptional efficiency in financial management. This synergy offers e-commerce businesses the flexibility and strategic insight needed for optimal planning and analysis. As technology evolves, keeping your tools interconnected ensures that not only does payroll run smoothly, but your entire financial ecosystem is robust and ready for future growth.

- Compliance Management: Automatic updates to comply with the latest payroll regulations are a must.

- International Payroll: Use a platform with automated global payroll processing for contractors and employees working across multiple countries

Popular Payroll Software Options:

| Software | Key Features | Price Range |

|---|---|---|

| factoHR Payroll | Integration, compliance updates | Contact for more |

| Zoho Payroll | Integration, compliance updates | $5 – $15/month |

| RazorpayX Payroll | Easy integration with Razorpay | $7- $12/month |

Comprehensive Comparison

To help you choose the best payroll software for your e-commerce business, we’ve created a detailed comparison chart below. This chart includes key features, pros and cons, customer reviews, and case studies for some popular global payroll software options.

| Software | Key Features | Pros | Cons | Customer Reviews |

|---|---|---|---|---|

| factoHR Payroll | Integration, compliance updates | Comprehensive features, good customer support | Higher price point, complex initial setup | 4.9/5 stars |

| Zoho Payroll | Integration, compliance updates | Affordable, easy-to-use interface | Limited advanced features, less customization | 4.5/5 stars |

| RazorpayX Payroll | Easy integration with Razorpay | Seamless integration with payment systems, scalable | Limited support for international payroll | 4.3/5 stars |

Vendor Evaluation Criteria

When evaluating payroll software vendors, consider the following criteria:

- Support Services: Check if the vendor offers 24/7 customer support, dedicated account managers, and comprehensive training resources. Good support is crucial for troubleshooting and quick resolution of issues.

- Scalability: Ensure the software can scale with your business growth. It should accommodate an increasing number of employees, more complex payroll structures, and potentially expand into new geographical markets.

- Trial/Demo Options: Look for vendors that offer free trials or demos. This allows you to test the software’s features, interface, and ease of use before committing to a purchase.

- Customization and Flexibility: Evaluate how well the software can be customized to fit your specific business needs. The ability to tailor workflows, reports, and user access levels can be crucial.

- Compliance and Security: Ensure the software is updated with the latest payroll and tax regulations and offers robust data security measures to protect sensitive employee information.

Choosing the right software isn’t just about features—consider the specific needs of your business and how well the software aligns with them.

4. Setting Up Automated Payroll Workflows

Now that you’ve chosen your software, it’s time to set it up. This step might seem like going the extra mile, but it’s the bridge to a smoother, more efficient payroll process.

A Step-by-Step Guide

Setting up automated payroll workflows can be straightforward with the right guidance.

Here’s a detailed step-by-step guide:

- Initial Configuration:

- Input your business details, such as company name, address, and tax information.

- Enter employee details, including names, contact information, job roles, and payment details.

- Set up payroll schedules (weekly, bi-weekly, monthly).

- Customize Workflows:

- Define specific payroll processes, such as overtime calculations, deductions, and bonuses.

- Set up automatic tax calculations and compliance checks.

- Integrate the payroll system with existing software (e.g., accounting or HR systems).

- Testing:

- Run test payroll cycles to ensure accuracy in calculations and compliance.

- Check all integrations to verify data flows smoothly between systems.

- Review generated reports for any discrepancies or errors.

- Go Live:

- After successful testing, switch to live payroll runs.

- Monitor the first few payroll cycles closely for any issues.

- Provide training to HR and finance teams on using the new system.

- Ongoing Support and Maintenance:

- Regularly update the software to the latest version.

- Conduct periodic audits to ensure compliance with new regulations.

- Utilize vendor support for troubleshooting and optimization.

Common Pitfalls

Incorrect Initial Configuration:

Pitfall: Errors in the initial setup can lead to incorrect payroll calculations.

Solution: Double-check all data entries and configurations. Use a checklist to ensure all necessary information is included.

Integration Issues:

Pitfall: Integrating payroll software with existing systems can sometimes cause data sync problems.

Solution: Work closely with your IT team and software vendor to ensure all integrations are correctly configured and tested.

Data Security Concerns:

Pitfall: Mishandling sensitive employee data can lead to security breaches.

Solution: Implement robust security protocols, including encryption, regular password updates, and access controls. Train staff on data security best practices. Encourage them to use residential proxies, strong business VPNs, and two-factor authentication to protect their personal and professional data from potential cyber threats.

Lack of Employee Training:

Pitfall: Employees and HR staff may struggle to use new systems effectively.

Solution: Provide comprehensive training sessions and easy-to-access documentation. Consider creating tutorial videos or conducting live training webinars.

Overlooking Regulatory Updates:

Pitfall: Failure to update the system with the latest tax laws and regulations can result in non-compliance.

Solution: Set up alerts for regulatory changes and ensure your remote payroll software automatically updates for compliance. Regularly review compliance settings

By following these steps, you can ensure a smooth transition to automated payroll workflows, reducing errors and improving efficiency.

5. Ensuring Compliance with Payroll Regulations

Navigating payroll regulations can feel like walking a tightrope. According to a report by the Workforce Institute at Kronos, 49% of professionals will start looking for a new job after experiencing just two payroll errors.

Automated workflows help ensure compliance by automatically updating systems with the latest tax laws and labor regulations, thus reducing the risk of costly penalties and employee turnover. Following proven payroll management tips can further improve accuracy and efficiency across your system.

Key Compliance Areas:

- Tax Regulations: Ensure your system automatically updates with the latest tax laws.

- Labor Laws: Adhere to wage laws, working hours, and benefits entitlements.

- Data Security: Protect sensitive employee information with robust security measures.

Global Compliance Considerations

Discuss compliance considerations for e-commerce businesses operating in multiple countries, including GDPR and CCPA.

Audit and Monitoring Tools

Recommend specific audit and monitoring tools that integrate with payroll software.

Regular audits and updates are essential to maintain compliance. Set your payroll software to automatically update and remind you of upcoming regulatory changes.

6. Monitoring and Analyzing Payroll Data

Data is the new oil, and your payroll data is a goldmine of insights. Monitoring and analyzing this data can help you make informed decisions.

(Image by Storyset on Freepik)

Key Metrics to Track:

- Total Payroll Costs: Understand where your money is going and identify potential savings.

- Employee Productivity: Correlate payroll data with productivity metrics to optimize workforce management.

- Compliance Flags: Monitor for any compliance issues that might need addressing.

Tools for Data Analysis:

Most payroll software includes built-in analytics tools. Use them to generate reports and gain insights into your payroll processes.

Advanced Analytics

Introduce advanced analytics features such as predictive analytics, anomaly detection, and real-time dashboards.

Integration with BI Tools

Discuss the integration of payroll data with business intelligence (BI) tools for deeper insights.

Monitoring and analyzing payroll data can provide valuable insights, helping you make better business decisions and optimize your payroll processes.

7. Continuous Improvement and Future Trends in Payroll Automation

The only constant in business is change. Embracing continuous improvement ensures your payroll processes stay efficient and effective.

Continuous Improvement Strategies:

- Regular Feedback: Collect feedback from your payroll team and employees to identify areas for improvement.

- Benchmarking: Compare your payroll processes with industry standards to ensure you’re on the right track.

- Training: Regularly train your team on new features and best practices.

Emerging Trends:

- AI and Machine Learning: These technologies are being integrated into payroll systems to predict and resolve issues before they arise.

- Blockchain: Offers enhanced security and transparency in payroll processes.

- Mobile Accessibility: Ensures payroll management can be done from anywhere, at any time.

Future-Proofing Strategies:

Offer strategies for future-proofing payroll systems, such as investing in scalable solutions and staying informed about industry advancements.

Adapting to Advancements:

- Stay updated with industry news and technological advancements.

- Be open to adopting new tools and techniques to stay ahead of the curve.

By staying abreast of emerging trends and continuously improving your payroll processes, you can ensure your business remains competitive and efficient.

Those managing HR and payroll processes can also benefit from a Twitter Scraper to monitor industry trends, track competitor announcements, and gain insights from relevant conversations on social media.

Common Challenges and Solutions in Ecom Payroll Automation

Despite the benefits, implementing payroll automation can present many challenges in e-commerce businesses:

#1 Technical Issues

Regular system maintenance and robust technical support can mitigate technical problems. Ensure your CRM software provider offers comprehensive support services.

#2 Data Accuracy

Initial data entry must be accurate. Regular audits and consistent data management practices help maintain this accuracy over time.

#3 Employee Queries

Introducing self-service portals empowers employees to manage their information, reducing the HR department’s workload and improving overall efficiency.

Future Trends in Payroll Automation for E-Commerce

Emerging trends such as AI and machine learning are being integrated into payroll systems to predict and resolve issues before they arise.

Ensuring you select the best data labeling tools can significantly impact the accuracy of your machine learning models.

A 2020 report from Deloitte indicates that more than 70% of organizations either process payroll in the cloud or are currently implementing a cloud payroll solution.

Here are Some More Emerging Trends:

- AI and Machine Learning: These technologies are enhancing predictive analytics, helping businesses forecast payroll expenses and optimize processes.

- Blockchain: By providing secure, transparent transaction records, blockchain technology improves data security and auditability in payroll management.

- Mobile Integration: Mobile-friendly payroll solutions allow for on-the-go management, making it easier for businesses to handle payroll tasks anytime, anywhere. This flexibility is particularly beneficial for remote teams and international payroll management.

Wrapping up

Automating your payroll management isn’t just about saving time—it’s about transforming your e-commerce business operations. From reducing errors to ensuring compliance, the benefits are immense.

By following these seven steps, you can enhance your e-commerce payroll management and set your business up for success.

So, why juggle flaming torches when you can automate and simplify? Embrace the power of automated workflows and watch your e-commerce business thrive.

FAQs – Payroll Automation for E-Commerce

Automating payroll can streamline your business operations by reducing errors, saving time, and ensuring compliance. With automated workflows, you can easily track employee hours, calculate taxes, process payments, and ensure timely payroll, even as your business scales. This allows HR and finance teams to focus on more strategic tasks, providing consistency and efficiency in payroll management.

When selecting payroll software, it’s important to consider factors like ease of use, integration with your existing systems, and the software’s ability to comply with the latest tax laws and labor regulations. The software should also be scalable, ensuring it can grow with your business, especially if you plan to hire more employees or expand internationally.

To set up automated payroll workflows, start by inputting your business details and employee information, then define payroll schedules. Customize workflows for overtime calculations, deductions, and bonuses, and set up automatic tax calculations and compliance checks. After testing the system with mock payroll runs, go live and monitor the first few cycles to ensure accuracy. Regularly update and audit the system to maintain compliance with regulations.

Common pitfalls in payroll automation include errors during setup, integration issues with existing systems, and security concerns related to employee data. To avoid them, double-check all configurations, work closely with your IT team to ensure proper integration, and implement strong security protocols like encryption and regular password updates. Additionally, ensure your HR and finance teams are trained to use new system effectively.

Automated payroll systems help you stay compliant by automatically updating to reflect the latest tax laws, labor regulations, and employee benefit rules. These systems can perform compliance checks to ensure you’re meeting legal requirements, reducing the risk of penalties or employee dissatisfaction. This ensures that your payroll remains accurate and in line with government regulations.

The future of payroll automation is focused on technologies like AI and machine learning, which will predict and resolve payroll issues before they arise. Blockchain will offer enhanced security and transparency for payroll, ensuring data integrity. Additionally, mobile-friendly payroll solutions will provide flexibility, allowing business owners and employees to manage payroll tasks from anywhere, which is particularly beneficial for remote teams.